Audit of the American Industrial Base

I want to know how healthy the American industrial base actually is, and what things need to be fixed so I can go fix them.

This is a very primitive audit, but makes for a good starting point.

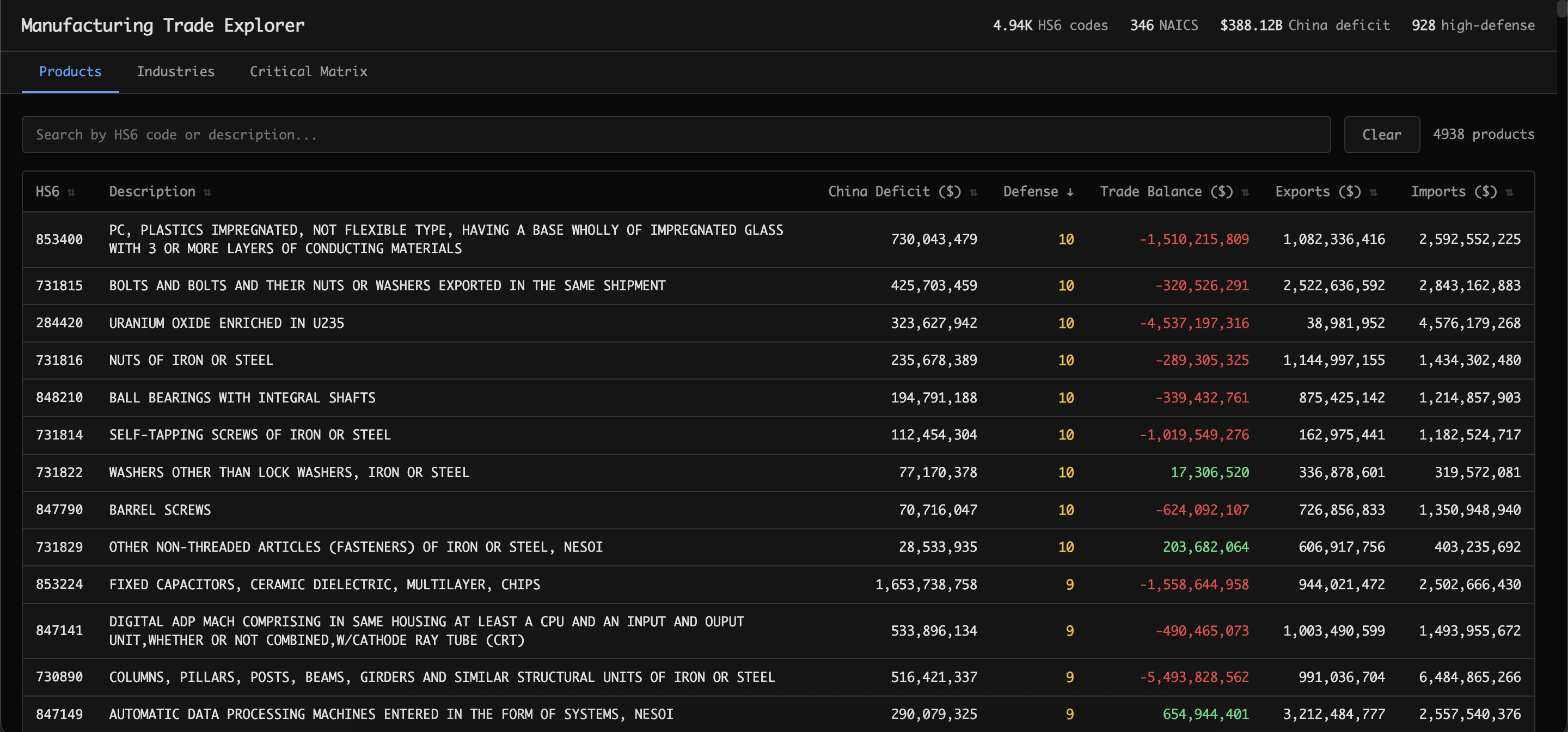

You can find the dashboard here.

Before we start, lets define some terms that will be useful:

What is NAICS, HTS, HS, and Schedule B?

All these things are standardized systems for classifying products and types of businesses.

-

NAICS (North American Industry Classification System) is a system for classifying the types of businesses and industries in the United States, Canada, and Mexico. For example, NAICS 311111 is "Dog and Cat Food Manufacturing".

-

HS or Harmonized System is a 6 digit code used to classify products globally. For example, HS 010221 is "Cattle; live, pure-bred breeding animals".

-

HTS or Harmonized Tariff Schedule is a 10 digit code used by the US to classify imported products for customs and trade statistics. For example, HTS 0102.21.0030 is "Cattle, Purebred Breeding, Male, Live, Except Dairy".

-

Schedule B is a 10 digit code used by the US to classify exported products. Usually, Schedule B and HTS 10-digit codes are the same, but not always.

So, for a business that makes aircrafts, it will have:

NAICS: 336411

HTS (several imported products with same NAICS):

| HTS | Description |

|---|---|

| 8802200115 | AIRPLANES AND OTHER AIRCRAFT, OF AN UNLADEN WEIGHT NOT EXCEEDING 450 KG |

| 8802200120 | NEW AIRPLANES, MILITARY, OF AN UNLADEN WEIGHT EXCEEDING 450 KG BUT NOT EXCEEDING 2,000 KG |

| 8802200130 | NEW MILITARY AIRCRAFT, OF AN UNLADEN WEIGHT EXCEEDING 450 KG BUT NOT EXCEEDING 2,000 KG, NESOI |

| 8802200140 | NEW SINGLE ENGINE AIRPLANES, NON-MILITARY, OF AN UNLADEN WEIGHT EXCEEDING 450 KG BUT NOT EXCEEDING 2,000 KG |

| 8802200150 | NEW MULTIPLE ENGINE AIRPLANES, NON-MILITARY, OF AN UNLADEN WEIGHT EXCEEDING 450 KG BUT NOT EXCEEDING 2,000 KG |

| 8802200160 | NEW AIRCRAFT, NON-MILITARY, OF AN UNLADEN WEIGHT EXCEEDING 450 KG BUT NOT EXCEEDING 2,000 KG, NESOI |

...

HS: This can be easily inferred from the HTS codes by stripping the last 4 digits.

Schedule B: For our analysis, we will ignore the caveat that Schedule B and HTS 10-digit codes are not always the same, and use the HTS codes for both.

Methodology

-

Get the NAICS codes for manufacturing (31-33). I got all 6 digit NAICS codes from

https://www.naics.com/search/, and cleaned it up to get the codes we are interested in. -

Now that we have the manufacturing NAICS codes, we want to know, for each NAICS code, what products are exported and imported. We will get this data from the Concordance that the US Census Bureau maintains. It defines a list of export/import HTS codes, and their respective NAICS codes.

-

Now, for each HTS code, ie, each product imported/exported by the US that is relevant to manufacturing, we get it's total 2024 trade data from the Census Bureau's International Trade Data. This tells us about how much of each product is imported/exported by the US in 2024, and from which countries.

-

For each product's trade data, we compute 2 metrics:

- China Deficit: trade deficit with China

- Defense Index: how critical the product is to the US defense (we compute this by asking gpt5 to score all ~4000 HTS codes on a scale of 0-10 based on a basic definition of defense criticality)

- [TODOS] I would like to calculate the following metrics in the future:

- China Index: Cost of product in China / Cost of product in the US

- Labor Index: Labor cost in the US / Labor cost in China